What is the market like for first home buyers? Better than you might think.

We contacted Westpac's housing experts to get their perspective on the current state of the housing market and to gain insights on what first-time homebuyers should consider.

First Home Buyers (FHBs) still have opportunities to get on the housing ladder despite higher interest rates, experts say.

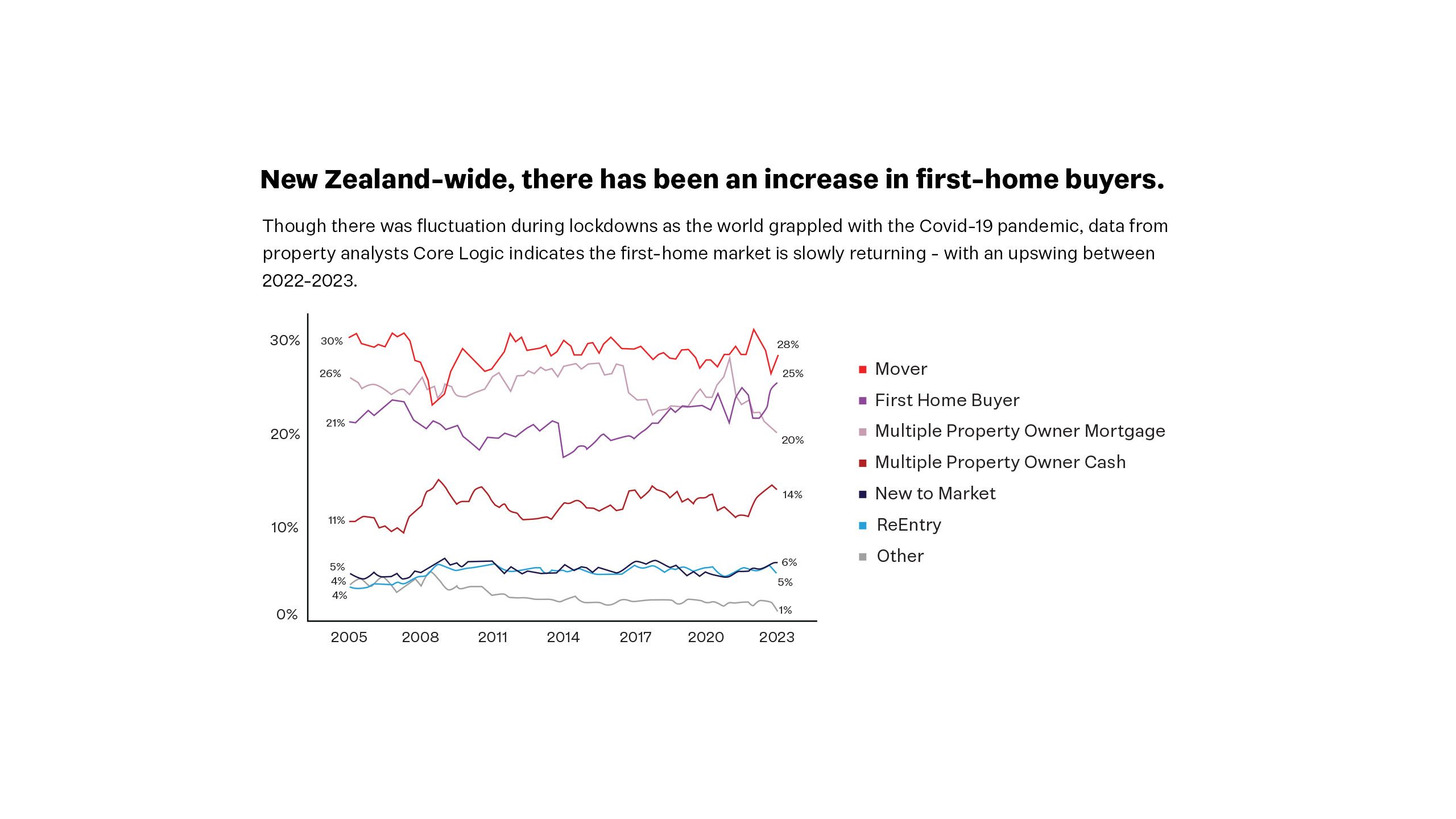

The Covid-19 pandemic, higher home loan rates and inflation pressures have contributed to a wild ride for house prices around the country over the past three years.

But CoreLogic Chief Economic Kelvin Davidson believes we’re heading for a more settled few years ahead.

“We could see lower house price growth over a five-year period than we’ve seen in the past once this current downturn is out of the way,” he says.

With home loan rates tipped to start dropping from 2024 onward, and lower house price growth, this could present some great opportunities for first home buyers in the market.

Stricter tax rules for property investors, such as the removal of mortgage interest deductibility for existing properties will stretch affordability for investors, impacting their activity in the market, Davidson says – potentially reducing competition with first-home buyers.

Less than 20% deposit? There are still plenty of ways to get into your first home

For First Home Buyers, Westpac’s First Home Partner scheme is an option. This is where you combine the support of a Shared Equity scheme with a Choices Home Loan, which could get you into your new home sooner. *

A Shared Equity Partner owns a share of your house equivalent to the amount of equity they put in, but they are not your landlord, and you will not pay rent. The Shared Equity Partner is normally a non-profit community organisation such as the New Zealand Housing Foundation, or a government affiliated organisation like Kāinga Ora.

There is also Westpac’s Family Springboard home loan, where your family could help by using their own home as security.

Alternatively, if you’re planning on building your first home, Westpac has two tailored home loan options to choose from.

For more information, check out the First Home Buyers hub on Westpac’s website.

Use your KiwiSaver to get into your first home

As well as providing for you in retirement, KiwiSaver also allows New Zealanders to get onto the property ladder. As long as you qualify, you could withdraw most of your KiwiSaver to buy your first home – then start building up your balance again for when you reach 65.

Why understanding the inflation game is key

While having the right people by your side is a great first step in getting into your first home, it is also important to do your own research to help you understand what is happening in the market - such as inflation and the OCR.

As interest rates tend to rise in tandem with inflation, first-home buyers are impacted.

The increasing price of goods and services during the current cost of living crisis, remains a large economic issue.

Michael Gordon, acting chief economist at Westpac, explains:

“Inflation is a rise in the general level of prices over time. Individual prices go up and down all the time, and we don’t worry about that. Inflation refers to when prices are rising across the board. When this happens over time we start to see the economic harms we associate with inflation.”

So, what does the OCR have to do with inflation?

Tasked with keeping inflation low, the Reserve Bank of New Zealand (RBNZ) uses interest rate increases as its main tool to combat inflation rises.

The RBNZ controls interest rates by changing the Official Cash Rate (OCR) — this is the commercial rate it charges banks.

The OCR tends to then set a benchmark for bank loan rates to customers.

Gordon says the Reserve Bank “ideally wouldn’t have to raise rates”, but market conditions have forced it into action.

“If they [the RBNZ] can act early and decisively, and people can be confident that inflation will stay in check in the future, then the adjustment may not need to be very large.

“The problem is that it’s often unclear at the time what counts as ‘early’, or what the scale of the inflation challenge is.”

Gordon says policymakers’ response to the pandemic and ongoing disruptions have led to higher, longer-lasting inflation.

“It’s now running at about 7% a year, well beyond the 1-3% range that the Reserve Bank aims for.”

Doing the research is key

It’s important to do your own research to help you understand what is happening in the market when looking to buy your first home. A good place to start is understanding terms like the Official Cash Rate (OCR) and house price inflation.

The OCR is the interest rate set by the Reserve Bank of New Zealand. It affects the price of borrowing and saving money in New Zealand and influences the level of economic activity and inflation. House price inflation is the rate of increase in prices over a given period of time, usually 12 months.

To help manage repayments and interest rate risk, you could consider splitting your home loan into different fixed-rate periods. For example, 50% of a loan could go onto a one-year fixed interest rate, while the other half could go onto a three-year fixed rate period. Longer terms can provide more certainty around what your repayment amounts will be, while having some of your borrowing on a shorter term will allow you to take advantage if interest rates drop.

If you’re looking to buy a home during a period of interest rate uncertainty, you may be able to “rate lock” up to 60 days before you buy your home or when your fixed term expires. If your interest rate is locked, your rate won't change between when you get the rate lock and closing, as long as you close within the specified time frame and there are no changes to your application.

Help and guidance on your home-buying journey

The key to buying your first home is having an experienced, trusted support network, says Westpac NZ Head of Home Loan Products Ben Carpenter.

Westpac works with industry experts to stay ahead of the changing market and ensure that customers are well-supported. Westpac Mobile Mortgage Managers can help customers through the sometimes-daunting home-buying journey.

“Our Mobile Mortgage Managers are experts in home lending and can help guide you through the process from start to finish,” Ben says.

“They are located across New Zealand, have local knowledge, and will meet you at a time and place that suits you.”

Westpac has great calculators and online tools to support you at whatever stage you’re at.

Every year, thousands of New Zealanders embark on their first home-buying journey.

It’s important to start with people you trust including a good real estate agent, lawyer and a bank that will support you every step of the way.

Westpac are there to help buyers who are ready to get on the property ladder with knowledge, expertise and guidance.

Visit the Westpac website to find a Mobile Mortgage Manager or explore savings tools to help you reach your financial goals.

Westpac's home loan lending criteria, terms and conditions apply. This material is provided for information purposes only, and is not a recommendation or opinion in relation to any particular financial advice product. We recommend you consult a financial adviser and a taxation adviser before acting on any information or general opinions, to take into account your particular investment needs, objectives and financial circumstances.

Westpac accepts no responsibility for the availability or content of any third party material to which this article may link or refer to.

BT Funds Management (NZ) Limited is the scheme provider and issuer, Westpac New Zealand Limited is a distributor of the Westpac KiwiSaver Scheme.

For more information about the Scheme, download the Product Disclosure Statement or visit westpac.co.nz, contact any Westpac branch or call 0508 972 254 or from overseas +64 9 375 9978 (international toll charges apply).

* When this article was published, Kainga Ora announced that this product was on hold as of 28 September 2023 due to unprecedented demand. For more up-to-date information, visit their website (https://kaingaora.govt.nz/home-ownership/first-home-partner/)