More than three million New Zealanders now have an enormous collective NZ$76 billion wealth invested with KiwiSaver.

And the days of being blissfully stuck in a default fund are long gone for a growing number of ethically-minded Kiwis.

With a healthy average balance of just over $20,000 per member, New Zealanders have started to take notice not only of their money going up but *what* their money is invested in – and how that affects the planet.

While still keen to maximise their savings for their first home or retirement, or provide for their family, a growing number of Kiwis are also staging a silent revolution.

“It was a good moment - for myself, for others, and for the planet,”

- KiwiSaver member Kate Hall

Shocking discoveries

For many global investors, the horror of realising their funds have been linked to environmental disasters, human trafficking, munitions, and slavery has juggernauted a financial reckoning and given way to a rise of ‘conscious investing’ – the act of putting your money where your heart (and mind) is.

Ensuring big business meets Environmental, social, and governance (ESG) criteria is key for those who want to wield power with their KiwiSaver.

A case in point is Kiwi eco-warrior Kate Hall, well known for documenting her life of sustainable living and ethical fashion advocacy via her Ethically Kate blog.

While Hall found success in encouraging others to ditch single-use plastics and recycle more, she says her most significant ‘a-ha moment’ came when she realised she could use her own KiwiSaver to wield environmental influence.

“It's embarrassing to admit, but it wasn't until I learnt more about finances when getting a mortgage that I actually understood I had a choice around where to put my KiwiSaver savings,” Hall says.

“Up until that moment, I hadn't thought about my KiwiSaver in the slightest. I had ticked the default box when first signing up and didn't think any more about it.”

Hall says she realised that while things like bamboo toothbrushes and keep cups did their bit for the environment, a much bigger impact could be made via the thousands of dollars she was saving and investing.

“That was the moment; it was a good moment - for myself, for others, and for the planet,” she says.

Hall’s mission is to encourage others to follow her path to conscious investing.

“It’s SO much easier than you think,” she says.

Globally, sustainable investing is unstoppable

Ethical investments have more than doubled in the past seven years.

Global growth in sustainable investments (USD$ Trillion)

Source: Global Sustainable Investments Alliance, March 2019

Good for the planet, good for returns

While the primary aim of KiwiSaver is to help New Zealanders get their first home and prepare for their retirement, many don’t actively get involved with what is arguably their most valuable saving tool. Around 381,000 KiwiSaver members are still with the default provider they were set up with, according to 2020 figures from the FMA.

But for those that do get involved, returns are key. The good news is doing good for the planet doesn’t have to mean sacrificing your balance. Return figures prove there is a strong correlation between good sustainability performance and good financial performance

Ethical KiwiSaver provider Pathfinder’s top three funds have been top performers in the past 12 months, with its signature Growth fund returning 31.8 percent for the year to the end of April 2021.

The power of meaningful change

New Zealand government policy now requires big business to declare climate impact.

But many Kiwis aren’t waiting for the government to step in to address rogue companies.

While private investors increasingly exercise their power to extract meaningful change across the world, a stream of conscientious KiwiSaver members are also transferring their balances to scheme providers like Pathfinder – New Zealand’s first carbon zero provider – who align with their values.

Retired Auckland academic Sue Abel chose to tackle climate crime head-on through her KiwiSaver

Retired Auckland academic Sue Abel chose to tackle climate crime head-on through her KiwiSaver

For Sue Abel, a retired Auckland academic and founding member of NZ’s The Values Party, a life dedicated to fighting issues of social justice meant it was a “no-brainer” that she chose to tackle business behaviour head-on through her KiwiSaver.

“I have been concerned for many years that big companies have been able to follow practices that are harmful to the wider society, including environmental impacts,” Ms Abel says, adding that gender and race discrimination inside companies was of equal concern.

“So when I discovered that ethical investing takes into account conditions of labour involved in the whole process of production as well as diversity in the company, it was an absolute no-brainer to invest in these companies.”

Global citizens are taking their voices to the streets, demanding political and corporate responsibility

Global citizens are taking their voices to the streets, demanding political and corporate responsibility

Returns don't come at the expense of ethics

Ethical KiwiSaver provider Pathfinder’s KiwiSaver Growth fund returned 31.78% for the year to the year of April, after fees and before tax.

“We are simultaneously working towards rectifying injustices… by investing in impactful companies,”

- ESG analyst Kate Brownsey

Making sense of climate investment

Wanting money to go into ethical investments is the first step towards making a change. But how does an ethically-focused KiwiSaver provider ensure the trustworthiness of companies?

In Pathfinder’s case, Environmental Social Governance (ESG) analyst Kate Brownsey is one of the people stepping up to the plate; investigating every investment opportunity through a broad sustainability lens, including a company’s carbon emissions and labour practices right through to how much its CEO earns compared to the average paid worker.

ESG analyst Kate Brownsey

ESG analyst Kate Brownsey

Technology also plays a large part. An automated tool called ISS provides ESG scores – an ethical report card of sorts – and other reports about how they fare on a sustainable level.

Brownsey says it is important to reward good corporate behaviour, by identifying companies hitting sustainable development goals in areas like clean water and sanitation, affordable and clean energy, and climate action.

“We know that the impacts of climate change are intertwined with inequality and injustices, with the people least responsible for climate change bearing its worst impacts.

“So it is also essential we ensure that as part of the low-carbon transition we are simultaneously working towards rectifying injustices present throughout our society by investing in impactful companies.”

Alongside reducing environmental impact for current and future generations through KiwiSaver fund management, providers are also able to have a say in big business.

Pathfinder uses and shares updates on its shareholder voting rights to influence companies on important ESG issues like sustainability, board diversity and, crucially, to veto detrimental company decisions.

Learning where your funds are invested

Kate Hall says the catalyst for change was the horror of understanding where her funds were being spent.

But as she acknowledges, it’s difficult to know where to start. For Kiwis who don’t know where or how their contributions are going, a first step can be to use an ethical calculator to ensure their provider aligns with their values and beliefs.

If not, it takes only two minutes to change provider.

All you need to do is grab your current NZ passport or driver’s licence and fill in a quick online form.

You don’t even have to contact your current KiwiSaver provider (if you have one) to make the switch – a new provider will do all that for you.

“It’s a light-bulb moment… when people can account for environmental and social issues, as well as make great financial returns”

- Pathfinder CEO John Berry

Making a sound decision

Pathfinder CEO John Berry says increasing numbers of Kiwis are realising the importance of being comfortable with where their money is invested.

“With climate change and our highly connected world, more and more people see the link between financial decisions and 'real world' impacts.

“This shift is the next step for consumers who already care about their spending decisions.”

John Berry, Pathfinder CEO

John Berry, Pathfinder CEO

Pathfinder has just become the first KiwiSaver provider to offer carbon-neutral funds - and the overall philosophy that drives their ethos is simple, says Berry.

“I believe the way we invest can encourage and enable positive change.

“This is in tune with what our investors want and what the world needs right now."

Berry says investors are becoming increasingly aware of the power they have as individuals to change corporate behaviour and slow the speed of climate change.

“I am a father, and like most people I want our world to be sustainable for our children and generations that follow.

“It's a light-bulb moment for people when they realise how empowered they are with KiwiSaver and other investments - they can account for environmental and social issues as well as make great financial returns," he says.

Do you know what your KiwiSaver is invested in?

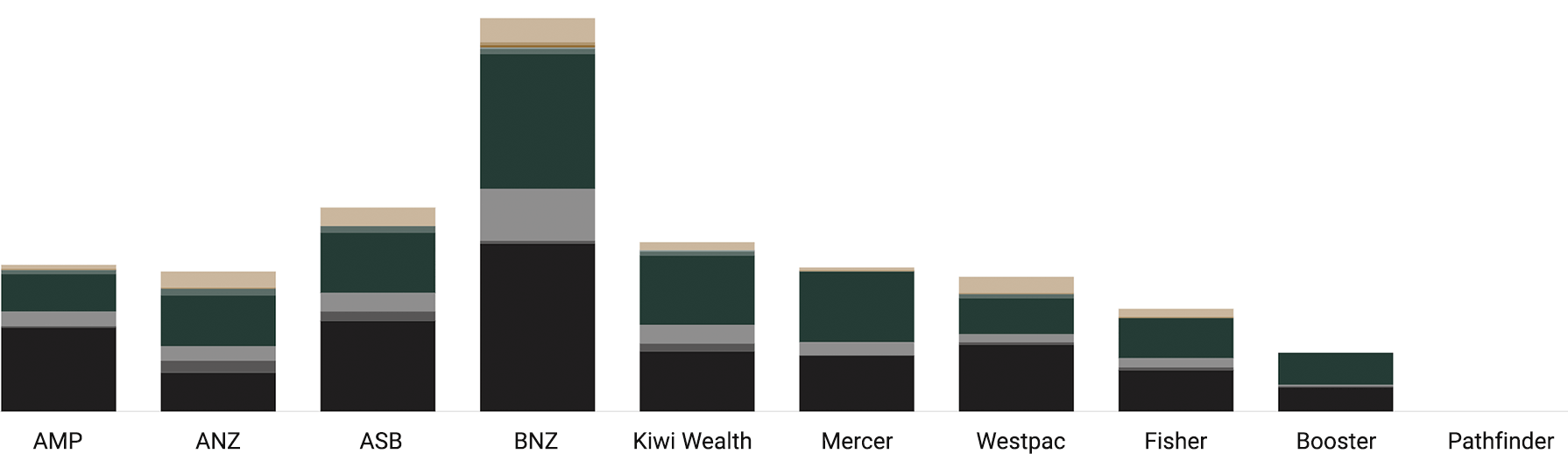

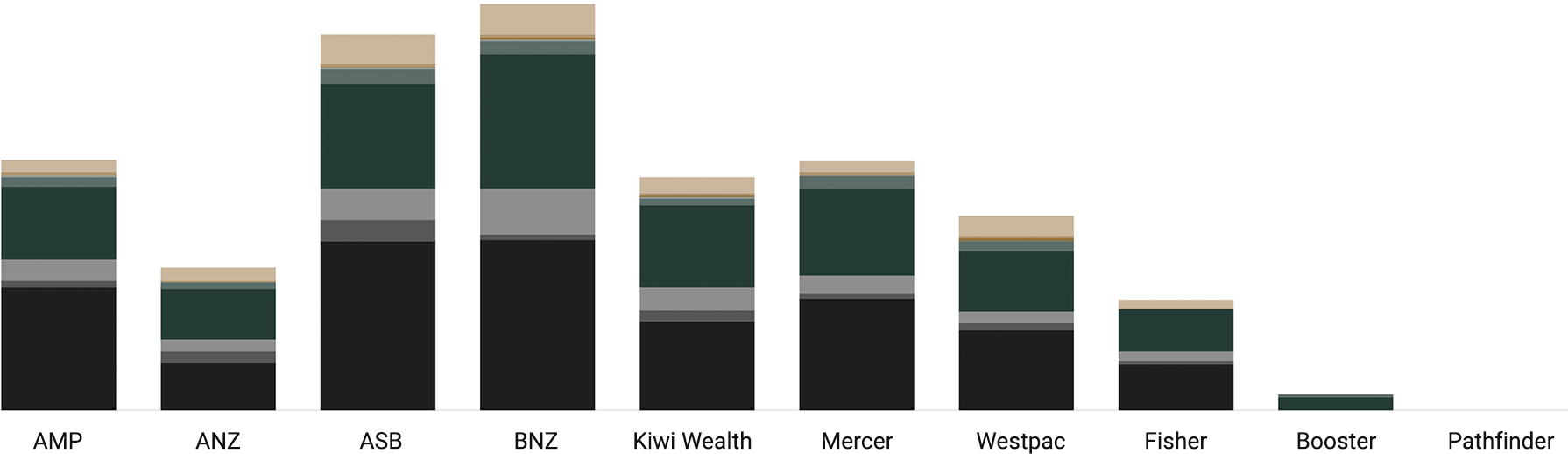

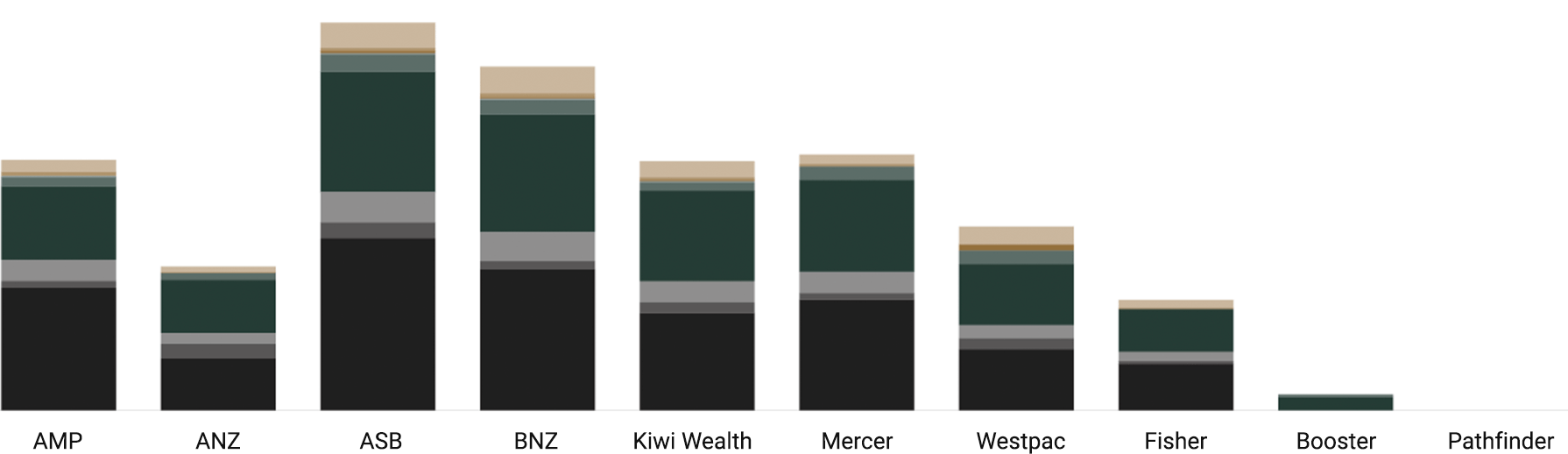

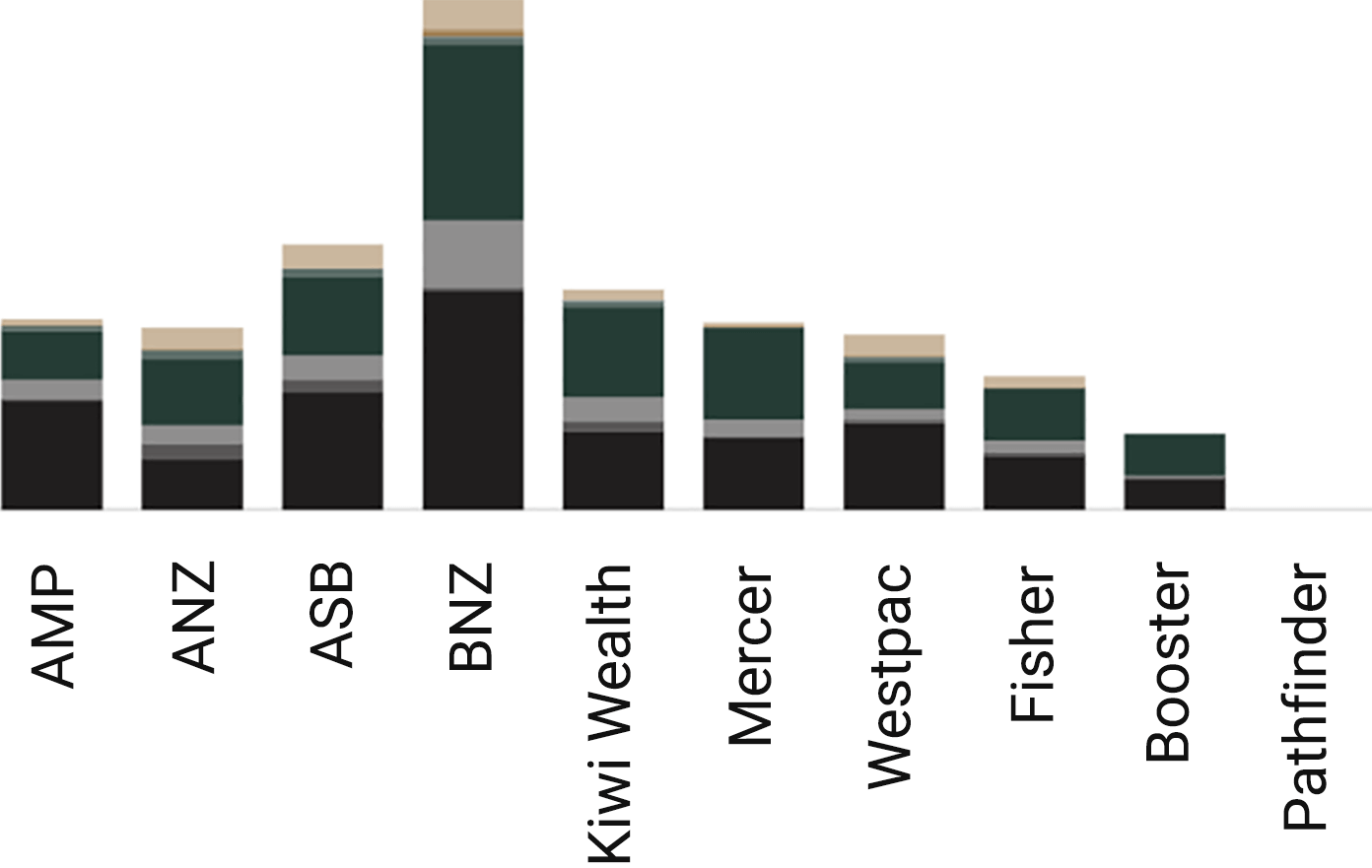

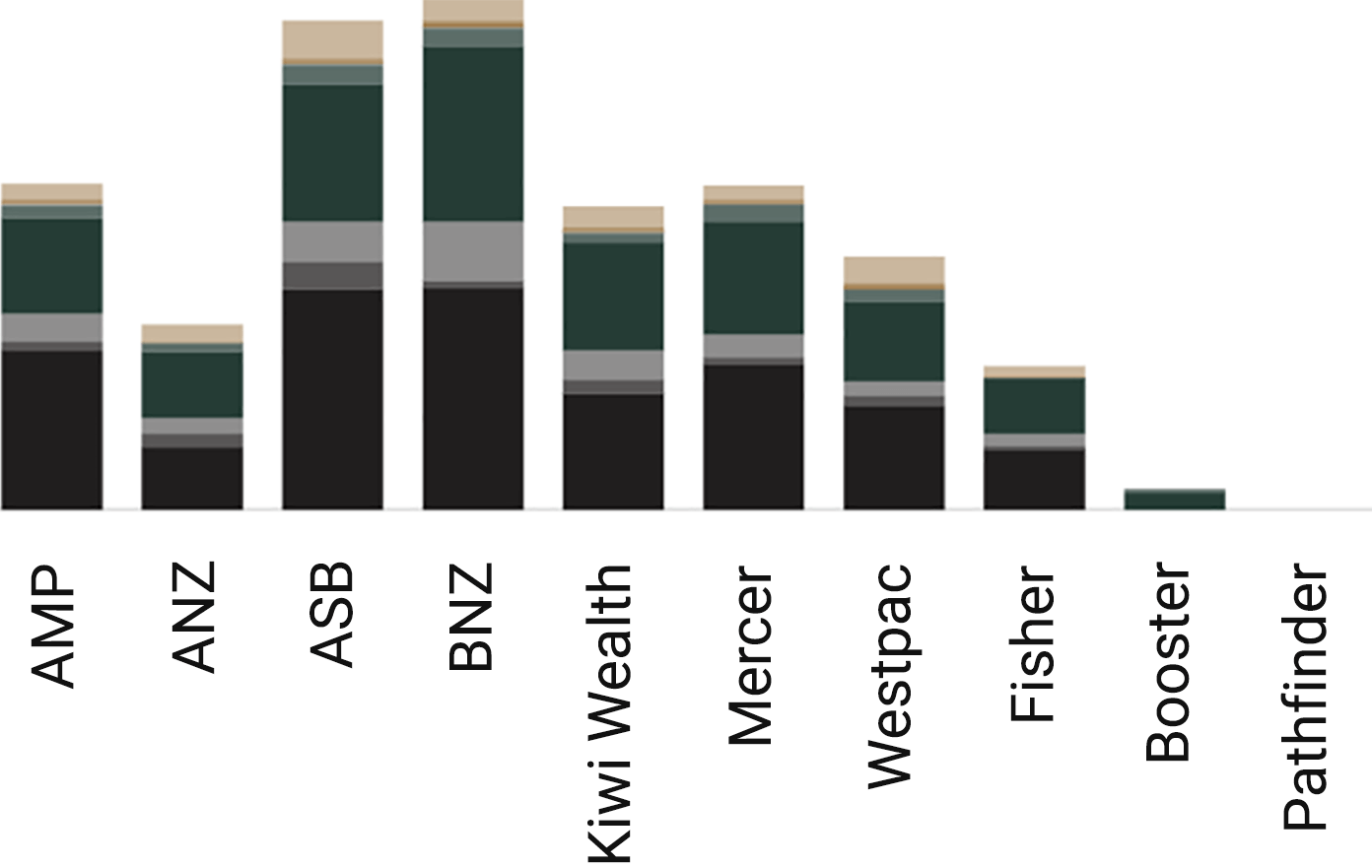

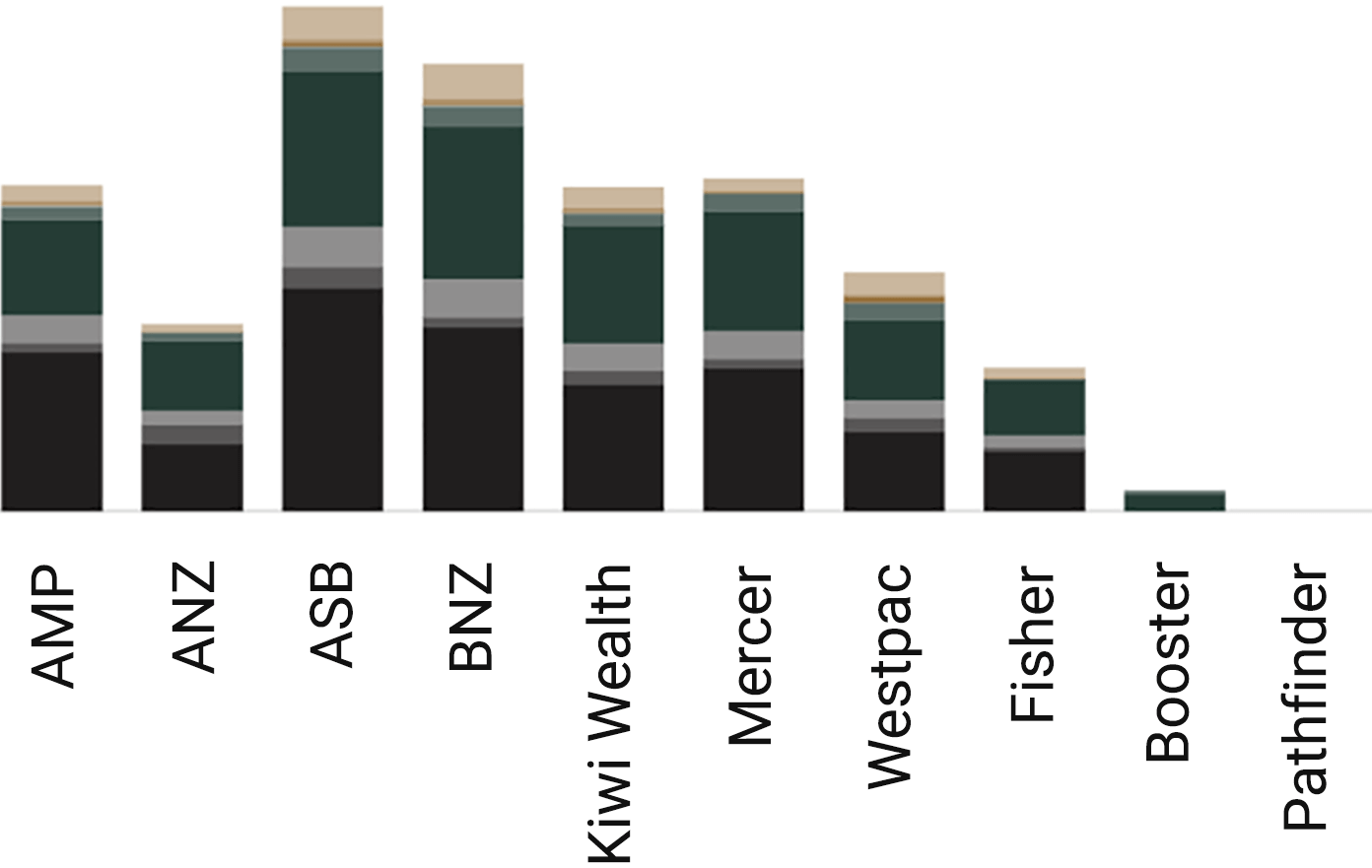

Each figure in this graph represents the percentage of investments by category as identified by ethical investing website Mindful Money.

For more details, go to https://www.path.co.nz/information-and-tools/calculators/#ethical-calculator

Do you know what your KiwiSaver is invested in?

Each figure in this graph represents the percentage of investments by category as identified by ethical investing website Mindful Money.

For more details, go to https://www.path.co.nz/information-and-tools/calculators/#ethical-calculator

Want your investments to be ethical?

Switch to a Pathfinder KiwiSaver plan today

For a Product Disclosure Statement visit path.co.nz